Alea

A new quarterly that’s a result of our whole team’s collaboration and insight.

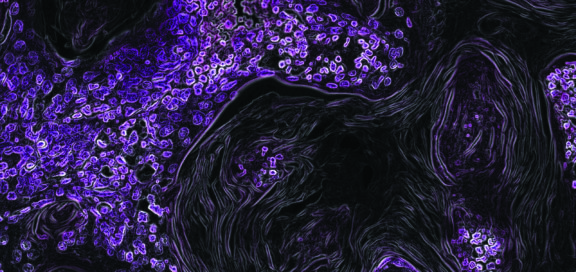

Each edition of Alea will offer an array of content from members of the Dice team as well as occasional contributions from industry big-hitters. However, the last thing we want to do is bombard clients who already spend their days buried in medical reports. For that reason, we’ve made sure to mix it up, combining industry insight and analysis with interviews and imagery that stirs the emotions.

Subscribe below to get the latest insights straight to your inbox.